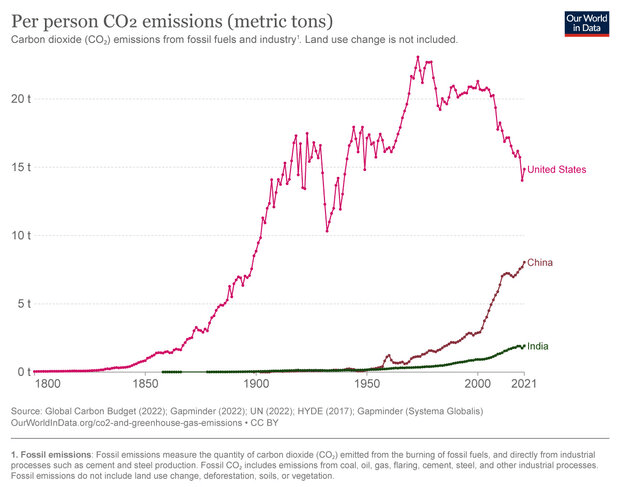

30 countries globally have a carbon tax, but one the highest contributing countries to climate change doesn’t have any form of one.

While many worry about economic concerns, increasing the cost of emitting carbon dioxide incentives using cleaner sources of energy, allowing us to make significant progress on tackling climate change and trying to reach climate goals.

Why don’t we just tax carbon emissions? – YouTube

Watch this video for more insight

A carbon tax encourages using clean energy technology potentially leading to more long-term economic growth and benefits. In addition, the carbon tax also allows for revenue to be generated for growing clean energy infrastructure and fund environmental projects.

Example of carbon tax: Let’s look at Canada. Canada has 2 parts to its carbon pollution tax. According to Canada.co, one for fuels like gasoline and natural gas, and a system for big industries. In addition, the government of Canada does not keep any direct money from the carbon tax, or what it calls “pollution pricing.”

Credit(s): How carbon pricing works – Canada.ca

Leave a comment